A heartfelt thanks to Ethan (MyShell) and Chris Lu for their guidance and help with this article. MyShell fam chat always gives me courage and motivation >3

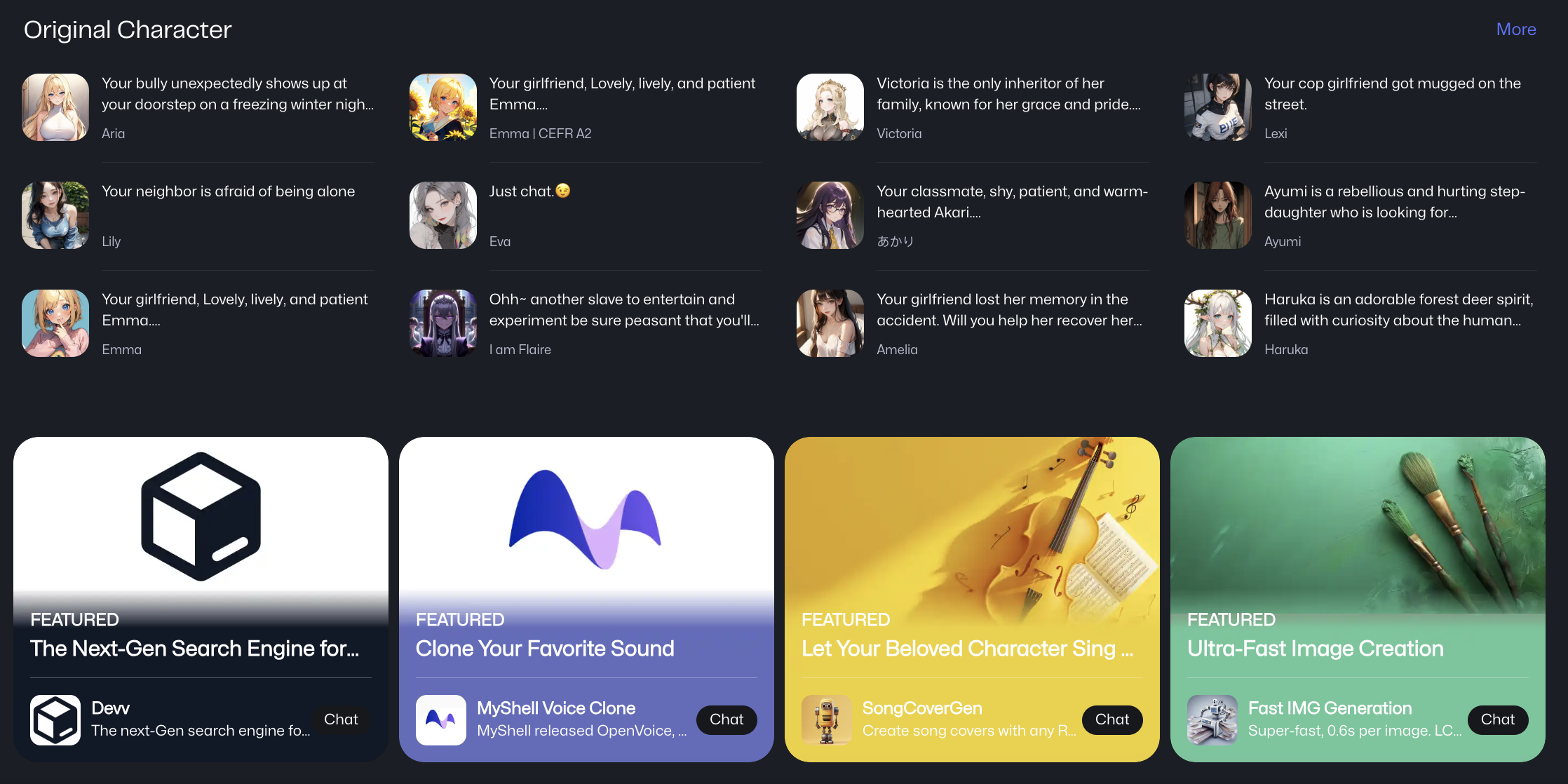

MyShell is a creator platform for AI Agents and AI native-apps, integrating mainstream proprietary models and a wealth of open-source models, providing diverse and user-friendly creative tools.

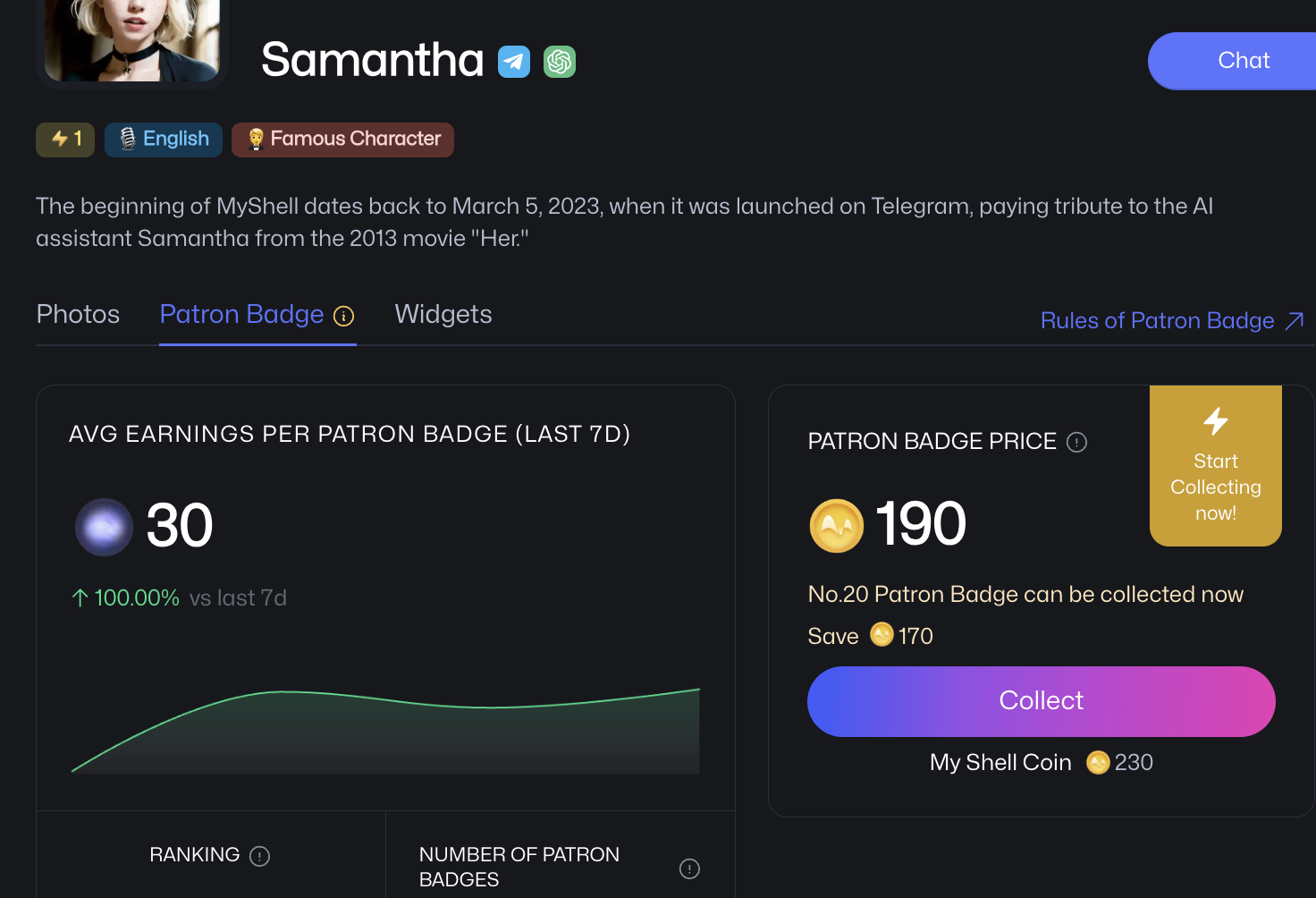

On January 26, MyShell launched its Patron Badge system, which allows all AI agents, chatbots, and apps on the platform to become open investment assets.

If you’re not familiar with MyShell, I highly recommend trying it out. It is You’ll see how a well-designed web3 economy system can power a high-quality AI platform and fuel a thriving ecosystem.

In this article, I will discuss:

- MyShell’s Patron Badge system - Alpha version;

- How this design supports the creator economy and reflects the team’s long-term vision;

- The potential expansion of this economy model in the future.

1. MyShell’s Patron Badge System - Alpha Version

Agent/APP as earning-assets

On MyShell, every interaction with an Agent or App consumes “battery” (a type of paid points). Different Agents or Apps, based on their language models, voice models, image models, and even video model or any other copoments will charge different amounts of battery for each interaction.

For example, a simple chatbot that only uses GPT3.5 with fine-tuning from the author will only charge 1 battery per interaction; while an image generation bot that uses an open-source language model and the official TTS voice model (OpenVoice from Myhell) will charge 13 battery per interaction.

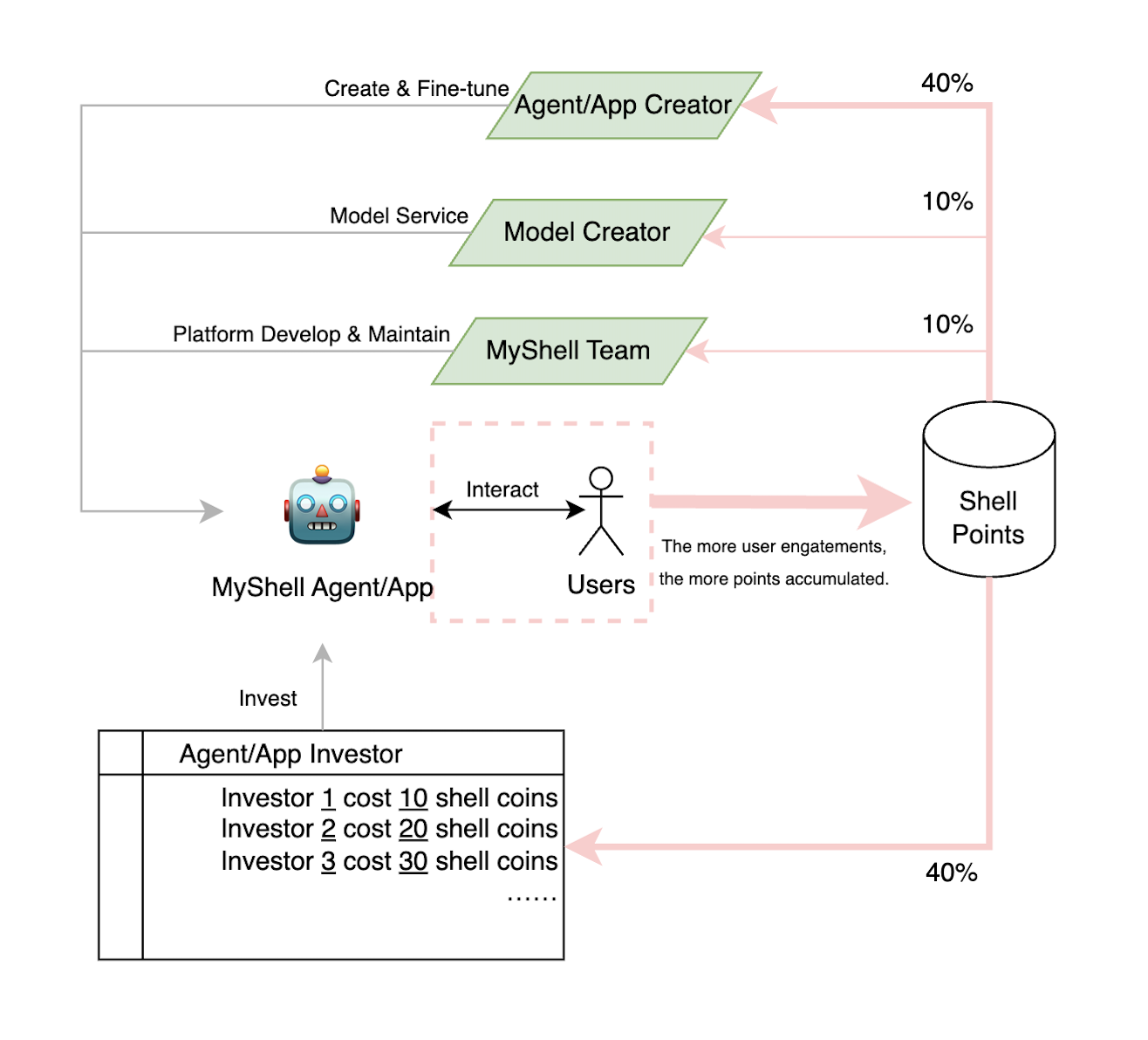

This is how MyShell prices Agents and Apps on the platform. Every public Agent or App that is effectively used 10 times can earn 100 Shell points. These points will be allocated proportionally to Agent creators, model creators, and Agent investors.

For creators, this means:

They can easily create unique and user-friendly AI agent/APP using multiple models on the platform . They’ll get the first share of the agent/APP (worth 10 Shell points) and future long-term interaction profits.

Open-source model creators can effortlessly earn points from MyShell (backed by tens or even hundreds of thousands of real users). Their contributions to the open-source community can be rewarded on the MyShell platform.

Creators can use the rewards they earn in the above steps to buy pass cards and create more publicly available Agents or Apps, creating new assets worth investing in for the platform. They can also invest in other Agents or Apps, becoming investors instead.

Here’s the investment process:

Purchase: Each Agent or App has an initial price of 10 Shell points. The price will increase by 10 Shell points every time someone else collects a badge for it. To prevent wash trading and price manipulation, investors can only collect one Agent or App per hour, and each user can only make three collections for the same Agent or App.

Earning: While holding an Agent or App, all of its investors can split 40% of the profits generated by other users interacting with it. The longer the holding time, the more profits investors can accumulate. The payback period for investors is different, as some may buy in at 50 points, while others may buy in at 500 points.

Selling: When a user decides to sell, they can get back 90% of their cost, plus the dividend points earned during the holding period. The early investor’s spot will be left open, and this spot is usually priced at half the current price or lower. Other investors may find this discounted price on the market and collect it at a lower cost.

In summary, the investment process is: purchase a promising Agent or App, actively promote it, and let more people interact with it. Wait for your passive dividends to exceed the 10% cost, and then you can start earning net profits. When you feel the profit rate is decreasing or you want to invest in other new potential agent/app, you can choose to sell, take back 90% of the cost plus all dividend income. Other investors will then discover the discounted cost price and invest in, promoting it and bringing it a new wave of hype and dividends.

Next, I’ll be explaining how this model incentivizes different participants in the ecosystem.

2. Unpacking the Edges of the Economic Model

MyShell’s economic model is more than just a set of rules. It’s a carefully crafted system, designed with a clear goal in mind. My hope is that readers will sense the team’s dedication to their core values and long-term vision.

1) Gentle Improvement of the Bonding Curve - Providing Investors with More Rational Thinking Space and a Foundation for Long-term Holding

MyShell has nearly 500 publicly available Agents/Apps, each with its own unique personality, fine-tuning, underlying model, and functions. Investors have a wealth of options and can make informed decisions and long-term investments based on the popularity and usage frequency of each Agent/App, and join in promoting it. Instead of being held hostage by the bonding curve and rapidly increasing numbers, and making impulsive and illogical investments like what web3 degens usually do in other projects.

2) Earning Dividends, Not Interest - Adhering to Long-term Investment and Empowering the Product

The price of an Agent/APP will rise as more people buy in, but if the Agent has not yet interacted with more users to generate dividends, investors cannot earn any returns. If they leave at this time, investors not only cannot earn profits from the price difference but also have to pay a 10% handling fee on their initial investment. Therefore, early entrants need to grow the pie together with later entrants instead of leaving early to reap the benefits of later entrants.

The correct investment mindset is: this design ensures that investors can redeem 90% of their initial investment, and the investment risk is very low. The upside potential of an Agent/APP is huge once it has gained popularity. Therefore, it is better to choose low-value but high-potential Agents/APPs, buy in, and promote them to increase interaction and earn dividend income through promotion. In a sense, this investment is more like staking mechanism. If you believe that some good Agents/APPs have long-term demand in the market, you can choose to buy in and avoid frequent trading to share the earnings in the long term.

Most importantly, the profits earned by investors depend only on the agent’s usage frequency, not on the number of buyers. This further provides more opportunities for price recovery for a wide range of assets (whether or not they have experienced hype). People will believe that once-popular Agents/APPs perfectly meet the needs of a small group of users, and even if they become quiet for a while, they will be discovered and regain popularity among another small group with the same needs.

The Rick bot (from Rick and Morty) on the MyShell platform is the best example, as it gained popularity when it was first created and is now regaining popularity due to the introduction of Patron Badge system. This proves that high-quality Agents/APPs can handle the new attention brought by product updates and financialization, and be loved by different user groups at different times.

3) Diverse Games Facilitate Value Discovery and Encourage the Emergence of High-Potential New Assets

Participants in the economic system may have these considerations: Due to different entry costs, the design of equal dividend sharing requires that the same Agent/AI needs to generate more interactions to break even when the price is too high. For example, with a purchase of 50 points and 500 points, the former only needs to earn 10 points to start making a net profit, while the latter needs to first earn 50 points to break even before making any income. Therefore, investors will engage in games and contemplation:

- Choose classic Agents/APPs. These assets can maintain a high frequency of use every day. Although they have been hyped to a higher price (like 500 points), they can earn more points every day.

- Choose emerging Agents/APPs, which are priced lower (like 50 points). After investing, promote this bot to generate more interactions with people.

Such trade-offs will make more people hope to discover emerging Agents. There will be more demand for new assets in the market, and every freshly baked Agent/APP will receive attention and hype from investors. Quality agents will be discovered for their value in this process, and may even flip those older classic agents; while flawed agents will expose their shortcomings after a wave of popularity, and investors can prompt creators to make improvements.

In addition, the “discount grab” mechanism for early investors to exit is also very interesting. When early investors give way, it allows new investors to invest in an asset at half or even lower of the current price. This mechanism actually stimulates a small number of new investors to quickly grab an old asset, to maintain the total value of the asset, and avoid the price slide and death spiral that occurs in the bonding curve; more new investors joining can again promote the asset, and can repeatedly stimulate an Agent/APP’s process of value discovery-promotion-hype-calm-again being discovered for its value.

"discount grab"

Last but not least, MyShell is committed to protect the interests of creators & contributors and crack down on those who maliciously exploit the system for personal gain. MyShell will implement strict risk control and anti-cheating mechanisms. The team Welcome users who want to invest in the creator’s ecosystem and can accompany MyShell’s growth in the long term, and inorganic and abnormal interactions will carry a higher risk of account suspension.

3. Long-term Expansion of the Economic Model - Building an Ecosystem, Not Just a Model

1) Agent/AI-native APP as Investable Asset

Why would the investment logic of investing in Agents and sharing dividends succeed on MyShell, and how would MyShell advance the FT-like betting system?

Let’s go back to the essence of MyShell as a creator platform and Agent/AI-native APP as an investable asset - that is, an irreplaceable tool platform, excellent native content supply, convenient AI agent asynchronous interaction, and easy and long-term investment.

Investors active in various web3 airdrop and point systems may be used to short-term bubbles stimulated by various FOMOs and wealth effects.

After friend.tech, there are actually many products with point systems, perhaps gamer’s companion, live-streaming and social game platform. Although they can complete the cold start through the FOMO point system, their products themselves have the following four pain points:

- Lack of irreplaceability in tools (can be replaced by traditional social media or APPs, such as X, Telegram, Twitch);

- Non-native content (more information may be spread on other social media like alpha group, not a new APP);

- Lack of synchronicity in interaction (the host must be online to answer questions);

- Lack of long-term convenient investment (requires the host and investors to conduct frequent transactions and operations, requiring high financial capabilities from investors).

| Friend.tech | Turnup | MyShell | |

|---|---|---|---|

| Irreplaceability of Tools | -Weak (other social platforms) | -Weak (other games and social platforms) | +Strong (can only create agents on MyShell) |

| Nativeness of Content | -Weak (other alpha group) | -Weak (other live streaming platforms) | +Strong (can only engage with agents on MyShell) |

| Synchronous Interaction | -Weak (the host must frequently reply in chat) | -Weak (requires streamers to be constantly online and frequently do quests) | +Strong (users can interact directly with agents bypassing creators) |

| Investment Convenience | -Weak (frequent transactions & users compete against each other) | -Weak, frequent transaction & users compete against each other) | +Strong (limited risk and passive income, conducive to expanding user base) |

In simple terms, MyShell has created a strong moat: creators must create here, users must use products here, and investors must invest here. Moreover, its investment is more suitable for a wide range of users to participate. This is irreplaceable by any other light-feature products (mini game platforms) and popular social media (Telegram, X), and with the growth flywheel of web3 open economy ecosystem, it becomes an even more insurmountable edge.

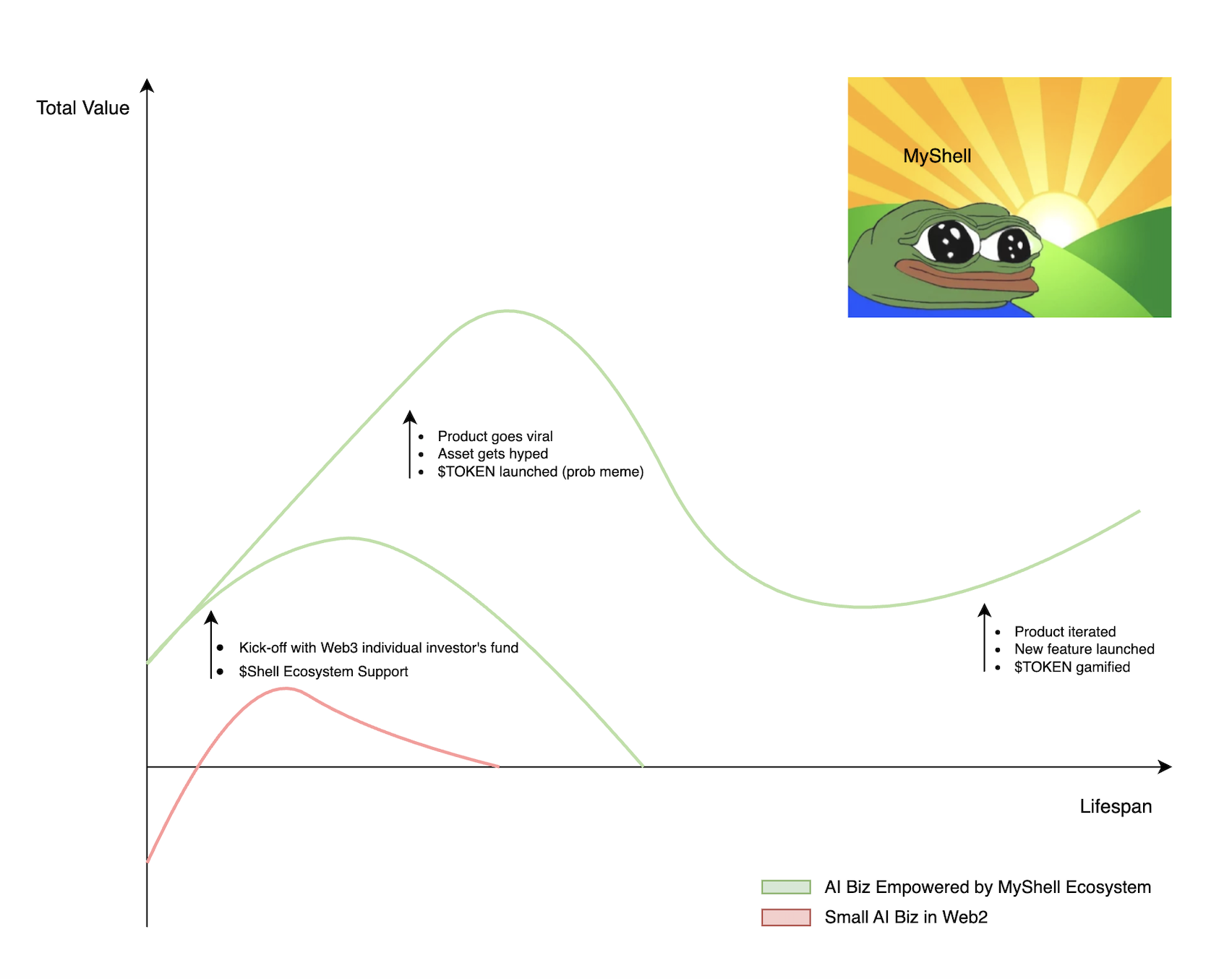

2) Empower Small AI Startups: Leveraging Web3’s Economic Flywheel for Fundraising, Product Launch, and Exit Strategies in Traditional AI Industries

“A small AI startup and a web3 project launched through IDO or DEX share many similarities.” -Ethan (Cofounder of MyShell)

Ethan and I once had an interesting brainstorming session, where we compared small AI products to $MEME, as they both share the following characteristics:

- Small funding size (low cost due to relying on open-source models);

- Fast product development pace (short development time, delivering products within a week, no time for fund raising or legal terms);

- Short life cycles;

- Goes viral and the pressure of a two-week earnings window (covering development costs and funding the next product).

Familiar short-term hit products, like the “Clever Duck Camera” or the “Escaping my AI Girlfriend,” quickly cashed in on their initial wave of popularity through subscription, one-time purchase, or ads. However, their cash flow was not sustainable. Behind these survivors, there are countless small AI teams and startup companies:

In the first quarter of 2023, there were 300% more small AI products than in the fourth quarter of 2022, with an average of 100 AI products released on Product Hunter every month. However, the number of AI startups established decreased by 70%, and 83% of these companies had fewer than ten employees. (source: Sortlist)

The data above shows that for AI and broader post-AI era products, small teams (<10 members) are emerging, while large companies are sharply declining.

Against the backdrop of a surge in startup products from small teams, changes in liquidity and monetization paradigms are also emerging. The majority of VC funds are flowing into giant companies, while more small AI companies may use their own funds or obtain angel/seed round investment, but subsequent PMF and monetization will pose significant challenges. Many small teams are still exploring PMF, with only a few briefly gaining trends through short video media, but they miss the heat before they have time to monetize.

Therefore, the paradigm innovation of AI entrepreneurship requires matching liquidity and monetization support, i.e., the Launchpad model and the IDO model.

Now, imagine a platform that 1) provides most open-source models and mainstream proprietary models, allows developers to quickly get started and delivery products; 2) has native currency and a large number of individual investors, can provide financial support in the early stages of the product; 3) and after a certain probability of the product becoming popular, can receive liquidity injection from the 24/7 financial market - such an innovative startup product launch platform is the role that MyShell will play.

At that time, the value of MyShell will be the sum of all AI products. It will be like Valve for indiegames, Kickstarter for consumer products, and Product Hunt for mobile internet apps, but it won’t stop there. MyShell will also have the traffic of Apple Store and the capital and liquidity of Launchpad/DEX.

3) More to come: Exploring and experimenting with the AI agent market and more valuable agent-related topics.

Due to product stages, confidentiality, and not wanting to distract readers from the alpha stage economic model, there are many possibilities about the ecosystem (already in the pipeline) that are difficult to elaborate on here.

I look forward to presenting these in future research articles. Such as:

- Fully on-chain agent market

- Trading agents with different strategies and personalities

- The game agents helping you optimize game strategies and botting, even bribing other agents

- Calls and interactions between agents

- …

All these powerful features will be integrated into a vast user ecosystem and economy in the future. For an ecosystem that has a strong technical execution and research team, and is highly inclusive/experimental/stable.

Launching the alpha version of the economic system doesn’t mean the end of the product, the MyShell ecosystem is just getting started; D

Afterwords

Over the past year, numerous AI and IP teams have reached out to me, all intrigued by the creator economy brought about by web3 (such as the largest GPT Prompt community in Web2 and famous anime IPs). However, they were unsure how to comfortably and safely incorporate the financial/investment characteristics of web3 into their communities and products. I’m thrilled to see MyShell taking the initiative to try this and embed it into their ecosystem. As the ecosystem evolves and the products iterate, this issue will be resolved, becoming a pioneer in the future development of the creator economy. You never know until you try.

In many of our previous discussions, we’ve repeatedly explored the combination of web3’s speculative characteristics and creators from web2, as well as the various possibilities this combination brings.

We know that due to the overly strong stimulating effect of web3’s economic system, many teams have become shortsighted and hasty for quick success. However, only those teams that truly care about the creator ecosystem and products are willing to spend time building an economic system, meeting all the “both-and” demands, and trying to get all participants in the ecosystem to contribute and receive the rewards they deserve.

On this point, the MyShell team’s response has always been consistent. They firmly believe that a method of moderate growth and sharing benefits can bring longer-term, more stable growth momentum. From day one, their goal has been to create a truly powerful AI tool that can rival the giants of web2, while sharing the benefits with creators and the entire open-source community. I’m delighted to see them fulfilling their promise through countless product iterations and explorations of the economic system.

In conclusion, if you enjoyed the content of this article or are interested in any AI+crypto crossover fields/economic system designs, feel free to follow MyShell’s official Twitter and also follow and DM me @0xAikoDai.

Also, MyShell is hiring! Welcome to contact the founder Ethan to discuss future career opportunities.

Disclaimer: Aiko’s employer, Folius Ventures, has invested in MyShell.